Get inspired

Renozee Latest News

Getting started in real estate investing

Real estate investing is a risky business. It’s not something that you should take on without doing your homework and having a plan in place. In this guide, we’ll go through how to get started with real estate investing by building a solid foundation for your new business venture. We’ll discuss what makes up the core of any successful real estate investment strategy, as well as how to identify your niche within the industry so that you can begin building out an effective portfolio from day one.

Understand the differences between rentals, rehabs, and flips

In real estate investing, when you buy properties to rent them out to others, this is known as a “rental.” Rentals are great for generating passive income because they always pay their bills and keep earning money for you while you’re away.

If you want to buy a property and make some quick cash by selling it later on at a higher price, then this is called a “flip.” Flips will bring in cash fast but can also cost more than rentals due to all of the time, energy, and risk involved with rehabbing an old house into something new again.

Define your investing approach

Your investing approach is the way you choose to invest your money. It can include how much time and energy you’re willing to commit, whether it’s just a few hours every week or 20+ hours per day.

There are many ways to invest in real estate, from flipping houses with no money down (which requires extensive physical labor) to wholesaling properties to others who do the heavy lifting for you. Each has its pros and cons, so let’s go over some of them:

- Flipping houses – This involves buying at auction or through private sale then renovating the property before selling it again. The investor typically makes money via cash flow from tenants or profits from the sale itself

- Wholesaling – As its name suggests, this method involves selling properties without ever taking possession of them; instead, buyers pay an upfront fee or percentage of the sales price and then pass along all work/duties involved in executing that deal including finding a buyer at auction who has enough cash available right now (i.e., not waiting until next month when they get paid).

Figure out your financials

- Determine your current income.

- Figure out what debt you have.

- Calculate your net worth.

- Figure out how much money you can invest and borrow, as well as determine your risk tolerance.

Choose a real estate investing type

Once you’ve decided to invest in real estate, your next step is to choose which type of investment you’d like to pursue.

Rental properties can be the most passive but will also require you to manage a team of tenants monthly.

Flips are often more hands-on, requiring regular work with contractors and other professionals—but also have a much shorter timeline for financing completion so that you can recoup your costs faster.

So how do you know what’s right for your goals? Here are some things to consider:

Get training for investing in real estate

The first step to getting started in real estate investing is to get some training. But what kind of training do you need? Where do you find it? How can you tell if the trainer is good and worth your money?

Set up your systems for tracking leads and deals

You need to set goals for yourself that are measurable, achievable, and realistic. This is where having a mentor or coach helps. If you’re not sure what your goals should be, think about how much money you want to make in three months, six months, one year, and two years.

Think of tangible fitness goals that can be measured by pounds lost or inches gained: “I will lose 10 pounds in 3 months” or “I will gain 1 pound per week for 4 weeks” are excellent examples of measurable goals. These types of goals are easy to track and see progress over time—so keep track!

If you don’t have an idea about what this looks like yet I highly encourage doing some research into different strategies based on your situation (there are tons of resources out there). Also, try looking at other people’s financial plans/goals/values/etc., nothing says we’re all exactly alike which can help when trying to build up some confidence in knowing that even though someone else may have achieved something similar – it doesn’t mean YOU can’t do the same thing too!

Begin building your team of professionals

- You should work with a real estate agent. Not only do they help you find properties to buy, but they can also guide you as you start learning about what kinds of properties are good investments and which ones aren’t.

- You should work with a lawyer. A lawyer can help guide you through the process of purchasing your first property, and even help facilitate some of the paperwork involved in buying it (though not all).

- You should work with a mortgage broker. A mortgage broker will be able to put together financing for your property purchase—and they may have relationships with lenders that allow them to get better rates than what might otherwise be available online or at other branches where there isn’t as much competition among lenders for new clientele like yourself!

- You should work with an accountant/tax professional who specializes in real estate investing because there are many intricacies related thereto that most accountants don’t know about unless specifically asked about such matters by clients who own multiple properties over long periods.”

- You should use the Renozee App to help you obtain bids from Home Improvement Contractors, saving you thousands on property renovation projects. It’s easy and free to use.

Determine your time commitment to finding deals and get started building a strategy to reach that goal

Real estate investing requires a great deal of time, research, and patience. It’s important to remember that this is a long-term investment; you may not be able to see results right away.

There are many different strategies you can use to find deals, but no matter what strategy you choose it will take some time to build your business and create a consistent flow of clients.

Investing in real estate isn’t something you do spontaneously – it’s something you need to be prepared for

Investing in real estate isn’t something you do spontaneously – it’s something you need to be prepared for! You have to have a team and systems in place before starting. You also need a plan of action and be prepared for the ups and downs of the real estate market.

Real estate investing can be a long-term commitment, so don’t expect overnight success.

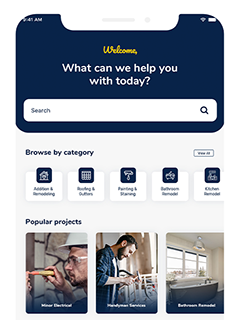

Real estate investors use the Renozee App

This is a big decision, and we want to be sure you’re prepared for it. We hope that this article has helped give you some insight into what to expect when investing in real estate, as well as how to get started on the right foot. If you’re ready to get started on investment property improvements, consider using the Renozee App to hire Home Improvement Contractors for less!

Are You A Real Estate Investor?

Download the Renozee App today to get connected to the most qualified contractors in town!