Get inspired

Renozee Latest News

Tips for Buying Your First Rental Property

Buying a rental property can be a great way to get into real estate, but it’s also an investment that requires careful consideration. Here are some considerations for buying a rental property, as well as things you should do before making any decisions about purchasing one:

-

Know your local market before you invest in real estate.

Before you buy a rental property, it’s important to know your local market. A lot of people make the mistake of thinking that all real estate is the same and that a house will appreciate in value no matter where it is. However, this isn’t true at all. While there are many factors that affect the cost of a home—such as taxes and investment property renovation — the biggest factor affecting the cost of an investment property is its location.

That’s why knowing your local market will help you choose which houses to pass on and which ones might be worth buying. For example: if there aren’t enough houses for sale in an area and everyone wants them, then prices will go up very quickly; but if there are plenty of homes on the market and not enough buyers (meaning demand has dropped), then prices can decrease drastically too!

-

Don’t plan to live in the property.

Before you make the commitment to buy a rental property, try to make sure that you can afford the costs associated with being a landlord. In addition to buying the property itself and paying closing costs, there are other expenses that come up when it’s time to make investment property renovations or collect rent. Therefore, many people decide not to live in their rentals: they don’t want to pay for these extra expenses! Instead of living in your investment property yourself, hire someone else to do it for you. If possible, hire an experienced professional who will work hard on making sure everything always runs smoothly (such as plumbers or electricians). The more money saved by outsourcing certain tasks means less stress for when things go wrong unexpectedly later down the road – like needing investment property renovations done quickly after finding out about them after moving into their brand-new home!”

-

Research all the costs of buying a home and financing it.

- Research all the costs of buying a home and financing it.

- Determine if you qualify for a mortgage.

- Calculate how much home you can afford to buy.

- Figure out if there are any advantages or disadvantages to getting a mortgage from your bank versus other lenders, such as credit unions or online lenders like Quicken Loans or LendingTree.

-

Plan to hold on to the property for at least five years.

There are several reasons why it’s important to plan to hold onto your property for at least five years. First, if you sell too soon, you’ll likely have trouble finding another property that will yield the same returns. Second, as we mentioned earlier, real estate is an illiquid investment—that means when you sell your rental property, it can take months for the money from the sale to be transferred into your bank account and for rent checks to stop coming in (unless there’s a tenant in place). You need enough time between when you close on the sale and when rent checks stop coming in so that the cash flow matches up with what is already invested in this investment vehicle.

Thirdly: Five-year holds are usually considered standard practice in real estate investing—and not just because of how long it takes for returns from one rental property after another; rather because these numbers make sense from an economic perspective too (in terms of both appreciation rates and investment property renovation costs).

-

Don’t skimp on home improvements or maintenance once you own it.

Once you own a rental property, don’t skimp on investment property renovation. This can hurt your chances of finding and keeping good tenants.

The cost of investment property renovation is far more than just the mortgage payment—the ongoing cost of things like new roofs, heating systems, and appliances adds up quickly. If you are not planning to live in the home yourself (as many investors do), then be prepared to hire people to maintain it for you. It’s important that these appointments are kept; otherwise, it can lead to bad reviews from would-be tenants who see that investment property renovations were promised but never completed in time for their move-in date.

A good contractor will give you peace of mind that your investment is being taken care of properly—and help ensure that no one steals anything out from under your nose!

-

Consider the potential for future appreciation and value.

When you’re looking at a rental property, it’s important to consider not only the current value of the property but also its potential for future appreciation. This can be especially true if you’re buying in an area that may show signs of gentrification or even just being discovered by tourists. If a neighborhood is growing in popularity, then rents will likely rise along with demand as more people move into the neighborhood and more businesses open their doors there. This can help increase your investment’s overall value—but only if you’ve purchased your property at a reasonable price relative to its current market value! It’s easy to get caught up in how much a home is worth now vs how much it might be worth later; don’t let yourself get swept away by this trap—instead, focus on what makes sense from both an investment standpoint as well as from an emotional one (if possible).

-

You should be in this for the long haul.

The idea of making a quick profit or having a place to live when you can’t afford anything else is understandable, but it’s important not to let these considerations drive your rental property decision. You will likely have to make sacrifices during the first year of owning a rental property—you might have to cut back on other expenses to make ends meet, and it could take some time before your investment starts paying off. But if you’re willing to stick it out through the rough times, there are many benefits on the horizon: building equity over time; not having any major investment property renovation costs; possibly even having neighbors who pay their rent on time (or at least don’t trash your place).

Purchasing a rental property

Introduction

Renting property is a good investment and can help you build wealth. The first step in making this type of investment is to understand what it takes, beginning with an understanding of how to purchase a rental property.

Rehab

Once you’ve found a property, how do you know if it’s worth rehabbing? When evaluating a potential investment property, start by looking at the neighborhood. If it’s in a good area and has good schools, that’s great! Those are two things that can make or break the value of your home.

Also consider whether or not there are other houses nearby that have been rehabbed recently—if so, this means there’s already demand for properties in the area with higher prices than what you’d pay for an older house needing work.

If all these seem like possible issues for a given house but still don’t deter you from wanting to buy it anyway (as they shouldn’t), it might be time for some research about how much work needs to be done before painting and decorating can begin!

Finding the strategy that works for you

If you’re not sure if you’re ready to buy a rental property, ask yourself these questions:

- What is my risk tolerance?

- What are my goals for the next few years, and how does purchasing a rental property help achieve them?

- Does my financial situation allow me to purchase a rental property?

- How long do I plan on holding this investment (i.e., time horizon)? Will I be able to handle the fluctuations that come with holding an income-producing asset over time without selling or refinancing it every few months? Is this something that can fit into my long-term plan?

If your answers were generally positive and encouraging, then you may be ready to begin looking at properties. If not, don’t worry; there’s no rush! But don’t put off making an informed decision forever either—you’ll need some experience before moving forward with additional investments of any kind (and even more so if they require financing).

Fix and Flip

Fix and Flip is a strategy that involves buying a property, fixing it up, and then selling it for a profit. This is a great strategy for investors who are looking to make a quick buck.

Let’s say you purchase a ten-unit apartment building for $250,000 and fix up the units so they rent out faster. You could sell them to other people at $500 per month in rent each—a total of $6,000 per month in income from your property (before taxes). At this rate, it would take about two years to recoup what you spent on purchasing the property plus additional money for fixing up the units. Then, when all is said and done, you would have made an estimated profit of $100k+.

Understanding the process of rental property investments

The process of rental property investments helps you know how to buy and make more on your investments.

As a landlord, you must understand the process of renting a property. The key is finding the ideal tenant or tenants for the property. You will need to ensure that you have a thorough screening process in place with credit and background checks for potential tenants so that you can avoid paying for damage caused by bad tenants.

Once you find the right tenant and they move in, it is important that they pay their rent on time every month without fail.

If at any point during this process, there are issues with either your tenant or their ability to pay rent then it’s important that these problems be resolved quickly so that both parties can move forward without any further issues affecting either party’s experience as landlords/tenants respectively

Conclusion

Residential real estate investing is something that’s incredibly simple and complex at the same time. The good news is that you don’t have to get started on your own. There are many resources available to support you along the way.

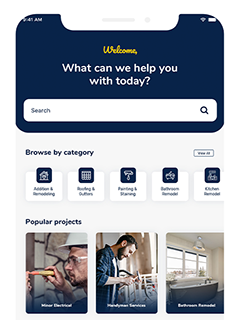

Rehab your next rental property using Renozee.

- Exclusive access to general contractors specializing in investment property renovation.

- Join over 500 real estate investors in the greater Cincinnati area

- FREE to use

- Contractors compete to win your business

Are You A Real Estate Investor?

Download the Renozee App today to get connected to the most qualified contractors in town!